Pawnshop loans. You won't need a credit Verify, but you are going to need an item of value as collateral which the pawnshop will promote if you can't repay your loan. If you cannot repay your loan via the owing date, you may be able to prolong it or renew it by spending a cost or perhaps the interest which has accrued.

To check for offers chances are you'll qualify for, Citi conducts a delicate credit history inquiry. Should you be offered with a suggestion and opt to proceed with the applying system, Citi will perform a hard credit rating inquiry which can have an effect with your credit score score.

You’ll need to do your study though — some unexpected emergency loan costs are as large as 600 percent with entire payment needed in two months. Understanding about crisis loans beforehand might help you keep away from taking on unaffordable credit card debt inside of a disaster. one. Private loans

Loans are subject matter to credit score approval and sufficient Trader commitment. If a credit union is selected to invest from the loan, credit score union membership are going to be necessary. Sure information and facts that LendingClub Bank subsequently obtains as Section of the appliance method (which include although not limited to details as part of your consumer report, your cash flow, the loan quantity that you request, the purpose of your loan, and qualifying financial debt) will probably be regarded and could influence your ability to obtain a loan. Loan closing is contingent on accepting all demanded agreements and disclosures at Lendingclub.com

Comparing Personalized Loans may be tricky. But you have the well-informed WalletHub Group in your aspect. Other buyers Have got a wealth of information to share, and we encourage Absolutely everyone to do so when respecting our articles tips.

In the event you need money in just a day or two to fund your crisis payments, personal loans, payday loans, bank card cash advancements and title loans provide the swiftest money. Of Those people possibilities, personal loans have the lowest prices and fewest disadvantages.

Emergencies can be expensive. Genuinely pricey. But a Lendly loan by CC Link might help alleviate many of the speedy economical tension. You may get the dollars you need, ideal whenever you need it — even if you don’t have perfect credit score.

Other aspects, such as our individual proprietary Web site regulations and regardless of whether an item is obtainable in your area or at your self-selected credit score rating selection, may effect how and wherever products show up on This website. Though we strive to offer a variety of delivers, Bankrate would not consist of information regarding each individual monetary or credit score goods and services.

Bankrate suggestion Be careful for predatory functions like prepayment penalties, upfront charges or substantial fascination prices.

Acquiring a loan from a colleague or member of the family may be a superior choice for you. You could possibly see that a loan from a person you believe in will have superior terms than a traditional loan.

The best loans to obtain accepted are loans that don't demand a credit rating Look at which include payday loans, pawnshop loans, car title loans, and private loans with no credit rating Look at.

"There are numerous lenders who will lend to the consumer which has a lousy credit rating score, but interest fees might be significant," Rafferty states.

OneMain Fiscal Personalized Loan disclosure: Not all applicants might be permitted. Loan acceptance and real loan terms depend on your power to meet up with our credit score requirements (such as a liable credit rating historical past, sufficient income after every month bills, and availability of collateral) along with your point out of residence. If authorized, not all applicants will qualify for larger sized loan amounts or most favorable loan phrases. Bigger loan quantities require a initially lien on a motorized vehicle no more than ten years outdated, that satisfies our worth prerequisites, titled with your identify with valid coverage. APRs are typically bigger on loans not secured by a automobile. Really-competent applicants may very well be available increased loan amounts and/or decreased APRs than These demonstrated earlier mentioned. OneMain charges origination costs the place permitted by regulation. According to the condition in which you open up your loan, the origination rate might be either a flat sum or maybe a proportion within your loan amount. Flat charge amounts differ by point out, starting from $twenty five to $500. Proportion-based mostly expenses range by condition starting from one% to ten% of your respective loan total subject matter to sure point out boundaries around the charge quantity. Go to omf.com/loanfees for more information.

Lenders generally read more demand a established fee for loans and might also charge penalties for late or skipped payments. Overview your loan agreement for facts about any rates that you simply could incur.

Val Kilmer Then & Now!

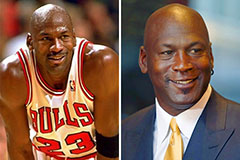

Val Kilmer Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!